Introduction

It has been incredible to see the growing discussion and engagement around the attractiveness of small funds in venture capital recently. Small funds play a critically important role across the venture ecosystem and we firmly believe that they represent the most attractive segment of the market to support and invest behind. That is why we built Pattern - a fund of funds focusing exclusively on identifying, accessing and empowering exceptional small funds, $5-50M in size.

That being said, while we agree with the conclusions of many of the recent reports, we do not entirely agree with the methodologies and frameworks being used to arrive at such conclusions. What we seek to do with this summary report is to unpack the fund data we have access to (~2,500 funds from 1980 onwards) and to introduce some frameworks that we believe to be instructive when analyzing the venture manager landscape.

TLDR

Our Data: The analysis below is based on a dataset of ~2,500 funds from 1980 onwards. The analysis is meant to be a starting point for further conversation vs. offering any definitive conclusions about which part of the market to invest in.

Alternative Frameworks: We introduce alternative frameworks for contextualizing which parts of the venture ecosystem might be the most attractive for allocators. This is built upon an internal concept of ours that overlays the required “win rate” of outperforming funds with the probability of finding such an “outperforming” fund.

Why We Are Attracted to Small Funds: Our data suggests that small funds have the most attractive combination of a low required “win rate” combined with a high probability of finding an outperforming fund. In our opinion, this sets the stage for significant outperformance at the portfolio level.

Venture is All About Access: It is essential to think about the “probability of access” when underwriting segments of the venture market. At a high level, small funds are harder to find but generally easier to access while larger, more established funds, are easier to find but significantly harder to access. Furthermore, it is extremely difficult, if not impossible, to access the top 5% of larger, more established funds ($150M+ in size). Removing these outperforming and largely inaccessible funds from the fund universe has a significant impact on the relative distribution of potential returns. This naturally has a disproportionately positive impact on the relative attractiveness of smaller, more accessible funds.

Significant Small Fund Outperformance Driven by Abundance of 5x+ Funds Combined with Probability of Access: We believe that a portfolio of small funds ($5-50M in size) has the potential to outperform a portfolio of larger funds ($150M+) by approximately 45-60% when adjusted for the probability of accessing the top 5% of larger funds.

Disclaimer: Pattern is exclusively focused on small funds with early-stage strategies. We believe our frameworks are designed to help us analyze the venture industry through this lens and recognize that these metrics and frameworks might not be appropriate for folks who have a preference for later-stage strategies.

Common Metrics for Evaluating Fund Size Attractiveness

There seem to be three primary metrics used to infer the relative attractiveness of a particular part of the venture ecosystem. These are:

Expected return (i.e. The average return of a fund within a particular fund size range.)

Probability of an “outperforming fund” (i.e. 9% of funds sized $0-50M deliver a 5x+ return which is 4x greater than funds sized $200M and above.)

The relative distribution of “outperforming funds” (i.e. 44% of funds with a 5x+ return are sized $0-50M.)

1. Expected return

From 1980-2018, the average return of funds sized $0-50M was 2.3x. This compares to ~2.1x for funds sized $50-200M, ~1.8x for funds sized $200-500M, 1.6x for funds $500M-$1BN, and 1.6x for funds larger than $1BN. This suggests that funds sized $0-50M outperform their larger counterparts by 12%, 30%, 42% and 42% respectively.

2. Probability of an “outperforming” (in our definition, 5x+) fund

From 1980-2018, ~9% of funds sized $0-50M generated a return of equal to or greater than 5x. That compares to ~6% for funds sized $50-200M, 3% for funds sized $200-500M, 1% for funds $500M-1BN and there were no 5x+ funds among funds sized greater than $1BN. That suggests that funds sized $0-50M are 1.4x, 3.0x and 12.0x more likely to generate a 5x+ outcome than funds sized $50-200M, $200-500M and $500M-$1BN respectively.

3. The relative distribution of “outperforming” (in our definition, 5x+) funds

From 1980-2018, ~44% of all 5x+ funds were funds sized $0-50M. That means that there are almost as many 5x+ funds sized $0-50M as they are in any other fund size category combined.

The Challenge With These Metrics

While these metrics are certainly compelling, we think that they can be misleading and potentially misinterpreted. While not exhaustive, see some reasons why below:

1. Expected return

Access: A big challenge with looking at the expected return is that it assumes that someone looking to invest in funds in a particular size range has an equal probability of identifying and accessing all funds in that distribution. That is simply not how venture works in reality. At a high level, small funds are hard to identify but relatively easy to access. Conversely, larger more established funds are easier to identify but harder to access. With venture capital being so power law driven, if you cannot identify and or access the top 5% of funds, then the expected returns for any fund size range decline significantly.

Dispersion: The expected return also does not give more context behind the dispersion of returns. As detailed below, we believe it is more informative to understand the following subcomponents of the expected return when establishing the attractiveness of a particular segment of the market:

What is the probability of finding a 5x+ fund?

What is the expected return of a 5x+ fund?

What is the probability of finding a sub-5x+ fund?

What is the expected return of a sub-5x+ fund?

2. Probability of an “outperforming fund”

You can’t take %’s to the bank: Regardless of one’s threshold for an outperforming fund (ex. 2.5x or 5x+) this statistic can potentially be misleading because it does not give an indication of the “depth” behind this percentage. As an allocator, we need a certain number of “outperforming” funds to hit our target return (see below). If a particular part of the market had 100% of funds delivering 5x+ returns but there were only 3 funds in that part of the market then it would be foolish for us to only spend our time looking at that part of the market because our implied “win rate” of accessing outperforming funds would need to be 100% (or greater) to satisfy our target portfolio return. To be clear, we think this is a helpful statistic but it needs more context.

Magnitude of outperformance matters: If two fund size buckets had the same number of funds and the same probability of generating 5x+ funds would they be equally attractive? This would depend on the magnitude of the outcomes. If the average return of the 5x+ funds in Bucket 1 was 10x and in Bucket 2 was 7x then Bucket 1 should be more attractive even though it has the same probability of generating a 5x+ fund as Bucket 2.

3. The relative distribution of “outperforming funds”

Bigger can be better, but not always: While it is helpful to know “where the winners are”, a high number is not always what you’re optimizing for. For example, 44% of all 5x+ funds are sized $0-50M. That is certainly interesting and appealing. However, independently it is not overly informative. If one is purely solving for the greatest distribution of 5x+ funds then why not look at funds greater than $50M in size because that’s where 56% of the 5x+ funds are. Again, to be clear, we think this is a helpful statistic but it needs more context.

Proposing a New Framework for Market Analysis

In order to analyze the relative attractiveness of the market, we believe the frameworks below better contextualize the risks and opportunities embedded across the venture market through the lens of the allocator.

The metrics that we believe are most relevant to consider are the following:

“Win Rates”: What is the required “win rate” of accessing outperforming funds in order for an allocator to hit their target return? We believe this is a new concept.

“Probability of Finding Winners”: How difficult is it to find an outperforming fund in a particular segment of the market? This is not a new concept but we believe it is powerful when used in conjunction with win rates.

The chart below shows that funds sized $0-50M have the lowest required “win rate” relative to the number of 5x+ funds in that segment of the market, combined with the greatest probability of finding a 5x+.

(Note that bubble size is indicative of the number of funds in a particular fund size segment of the market. We think this is a helpful, albeit loose, proxy for the amount of time and resources it might take to comprehensively underwrite that segment of the market.)

“Win Rates”

The “win rate” was built to help an allocator contextualize what the effective hurdle rate for success looks like in a given part of the market. Win rates are predicated on the following two questions:

1) In any particular part of the market, how many “outperforming” funds do I need in my portfolio to hit a target level of return at the portfolio level?

2) How many “outperforming” funds are there in the part of the market I’m focusing on and how does that compare to the number of outperforming funds I need to find for my portfolio?

The “win rate” is therefore a hurdle rate or “believability” index associated with your strategy and the part of the market you have chosen to invest in. i.e. “What do I need to believe about my ability to source, underwrite and access 5x+ funds in order for me to succeed with my strategy in this part of the market?”

On average low win rates are “better” than high win rates but this too needs more context.

It might be tempting to associate win rates with difficulty. That can be misleading. Rather, we think win rates are more helpful in allowing the allocator to understand how much they can miss / how much can go wrong while still allowing them to hit their target return.

Equally, win rates need to be contextualized alongside the “right to win” of the allocator. The more sophisticated the allocator, the better they can source, underwrite and access winners. Higher required win rates might be less intimidating for them than the average allocator.

You will notice that this framework blends together the concepts of 1) the expected return and 2) the distribution of outperforming funds shown above but we believe it does so in a way that provides more context than either of the original metrics do independently.

Let’s dive in.

How Many 5x+ Funds Do I Need?

For the sake of simplicity, let’s assume that an allocator is looking to build a portfolio that delivers a return of 3.0x (yes, that’s high) and let’s also assume that the threshold for a fund to be an outperforming fund is 5x (also a high number).

What one then needs to do is to understand the following for a given part of the market:

What is the expected return of a 5x+ fund?

What is the expected return of a sub-5x+ fund?

Knowing these data points (as well as our target portfolio return) allows us to establish what % of the portfolio (assuming all positions are equal weight) needs to be in 5x+ funds in order to meet or exceed our target return.

Calculation of what % of funds need to be 5x+:

(% of portfolio in 5x+ funds * expected return of 5x+ funds) + (% of portfolio in sub-5x+ funds * expected return of sub-5x+ funds) = expected portfolio return

What we are doing is unpacking the concept of expected return and understanding the magnitude of returns for “outperforming” and underperforming funds in a particular fund size category. The greater the magnitude of the outperformance, the fewer the number of outperforming funds one might need in their portfolio.

For example, for funds sized $0-50M, the expected return of 5x+ funds was 8.3x and the expected return of sub-5x+ funds was 1.7x. Knowing this, we estimate that 19% of the portfolio would need to be in 5x+ funds in order for the overall portfolio to deliver a 3x return in this part of the market.

i.e. (19% * 8.3x) + (81% * 1.7x) = ~3x (any differences due to rounding)

Below is a summary of these data points across a range of fund sizes spanning fund vintages from 1980-2018.

Using this data, we can then calculate the required % of the portfolio that needs to be in a 5x+ fund for any part of the market. (If you see 0% that’s because there were no 5x+ funds in those fund size ranges in our data).

How Many 5x+ Funds Do I Need and How Many of Them Are Available?

If one assumes that an average portfolio will have 20 funds then one can calculate the number of 5x+ funds required in a portfolio. Using the same example as above, a 20-fund portfolio of funds sized $0-50M would need approximately four 5x+ funds to deliver a 3x portfolio return. (i.e. 19% * 20 funds = 3.8 5x+ funds.)

This target number of 5x+ funds can then be expressed as a percentage of all of the 5x+ funds in that fund size range to arrive at the implied “win rate”.

Calculation of the “win rate”: (# of required 5x+ funds to hit target return) / (# of 5x+ funds in the target fund size range).

This is where the distribution of 5x+ funds becomes more relevant. Below is the distribution of 5x+ funds by fund size. Notably, 44% of all 5x+ funds are sized $0-50M.

Using the above formula, we can calculate the required win rates across different parts of the market:

Combining Win Rates with Probability of Success

Like any metric, it is important to be aware of the shortcomings of the win rate. Win rates can be manipulated by expanding the size of the target size range of the market.

For example, if you were to look at a fund size range of $50-150M (vs. $50-100M and $100-150M individually) the win rate seems to decline substantially, from 8-10% to 5%.

By expanding the size of the target market, the number of 5x+ funds in the target fund size range tends to increase to a greater degree than the numerator does. That is because you are not changing the size of your portfolio as you grow the size of your addressable market.

This vulnerability of the metric reinforces the need to combine it with another metric that is both a compromise of changing the range of the addressable market and which is also a relevant output for contextualizing the attractiveness of a market segment.

Estimating the Probability of Success

While expanding the target fund size range can lower the required win rate, it will simultaneously have an impact on the probability of finding a 5x+ fund in the expanded target range.

As allocators analyze which part of the market to focus on, presumably they would be solving for a part of the market that has an “attractive” or even requisite combination of:

1. The lowest hurdle for success (aka a low win rate); and

2. Where the probability of “winning” is the highest (aka the highest probability of finding a 5x+ fund).

Looking at the chart below, we see that funds in the expanded fund size range of $50-150M have a lower win rate than either sub-market ($50-100M or $100-150M) but that the probability of finding a 5x+ fund is now somewhere between either sub-market.

We believe this framework is helpful because it helps the allocator better contextualize the impact of changing their target fund size range.

For example, if one decided to change their focus from only looking at funds sized $100-150M to also including funds sized $50-100M then the benefit of a lower win rate will be matched with both a lower probability of finding a 5x+ fund, combined with a doubling of the number of funds you in your addressable market that would need to be sourced and diligenced.

Outputs vs. Conclusions

To be clear, we think the outputs of this are very compelling for small funds, specifically those sized $0-50M. Expanding the investment range outside of $0-50M would most likely have a negative relative impact on both the win rate and the probability of finding a 5x+ fund. This is why we are exclusively focused on this part of the market.

That being said, we believe that the results here should be reviewed as an output and not a conclusion. Not only will every allocator have their own goals and target returns but every allocator will have a different “right to win” and that will have implications for which part of the market they seek to play in.

We believe allocators are differentiated on at least three vectors:

Sourcing

Picking

Winning

These factors have an impact on how an allocator might be able to compete relative to the rest of the market in their target fund size range. For example, allocators with established brands as long-term partners (endowments etc.) might be less intimidated by a higher “win rate” than a new family office.

An important point worth mentioning as well is that while these statistics might seem clear in hindsight, they likely underestimate the challenges of executing these strategies in practice.

For example, if one decides to focus on funds sized $0-50M then one needs to make sure that:

1) They have the right resources and infrastructure to screen the market. Most small funds are not well-known and or established. This makes it harder to find them.

2) They have the requisite experience to identify outperforming GPs with limited track records. Most small managers have limited track records. This makes it harder to underwrite them.

3) They can earn the right to build an allocation in the most promising funds when these funds are often met with more demand than they have supply. There is a finite amount of capacity in each fund. This makes it harder to access them.

It is also worth recognizing that while small funds seem to be very attractive, underwriting this part of the market is extremely resource intensive given the sheer number of funds.

Venture is About Power Laws and Access

There has already been a lot discussed in this post but we would be remiss if we did not talk about the importance of access when underwriting the venture landscape.

While small funds already seem to be “more attractive” on either the original statistics or through our frameworks, this relative attractiveness grows significantly if one adjusts the data for the probability of accessing the top 5% of funds in more established parts of the market.

On average, small funds are harder to find but easier to access once you find them. Conversely, more established funds are easier to find but harder if not impossible to access. There is simply no chance you are going to be able to invest in the likes of Benchmark, Sequoia, USV, etc. If that’s the case, then is it fair to include this top cohort of funds in the analysis? For some folks maybe, but for the significant majority of the rest of us, that answer is no.

It’s not clear where to draw the line between what level of performance is “inaccessible” (i.e. is it the top 5% of funds, the top 10%?) and at what stage in a managers’ journey that access issue becomes more relevant (i.e. Fund III and beyond? Funds $150M and beyond?).

While we acknowledge the analysis below is not perfect, we do find it to be informative. We have made the following assumptions:

We analyze data for funds with vintages from 1996-2013. (See why below).

We assume that the top 5% of more established funds are inaccessible and we remove them from our data set.

We use fund size (there are data quality issues with fund counts) as a proxy for GP maturity and assume that access becomes a problem for funds $150M and above.

We do not assume any access issues for funds $150M and below.

We have chosen the following fund size ranges for this analysis:

$5-50M (we remove $0-5M because those funds sizes are often too small for most allocators)

$50-150M

$150M and greater

$200M and greater

Vintage Selection

There are generally discreprencies across the vintages used when presenting return statistics. Based on our data, we believe that the period of 1996-2013 is most fair when analyzing returns across different fund size ranges.

What you see in the data below is that larger funds only become more meaningfully represented in our data from 1996. We believe that this is generally in line with how the industry structure has evolved over the same time period.

We decided to cut off our analysis at 2013 because funds generally have 10-year fund lives and we wanted to make sure there was as little noise as possible between TVPI and DPI.

We have separately analyzed more recent vintages and believe that the apparent relative attractiveness between smaller funds and larger funds continues to hold true in more recent vintages (see 2014-2019 below) but have decided to not include that analysis in this report for the reasons listed above.

The Importance of Access

What you can see below is the relative distribution of “outperforming” funds by fund size range. We show the data for funds generating returns of 3x and above, 5x and above and 7x and above.

Without adjusting for access, funds sized $5-50M are ~4x more likely to generate a 5x+ return than funds sized $200M and greater. Furthermore, ~36% of all 5x+ funds are sized $5-50M.

Probability of Finding Outperforming Funds and Distribution of Outperforming Funds (No Adjustments)

However, if you believe that the top 5% of funds sized $150M and greater are inaccessible and you strip these funds out of the data set, you are left with the following:

Removing the top 5% effectively removes all 5x+ funds for funds sized $150M and greater.

Furthermore, of all of the remaining 5x+ funds, ~59% of them are sized $5-50M.

Probability of Finding Outperforming Funds and Distribution of Outperforming Funds (Strip out Top 5% for Funds Sized $150M and Greater)

Portfolio Simulation

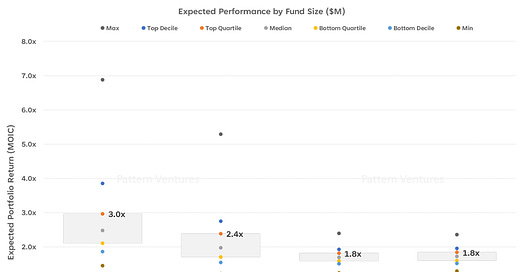

The implications of this are significant to say the least. What we then did was build 1,000 20-fund portfolios across each range of fund sizes (4,000 portfolios total) and stripped out the top 5% of funds sized $150M and above to get an estimate of the potential distribution of returns at the portfolio level.

What we see below is that a top-quartile portfolio of funds sized $5-50M should outperform a top-quartile portfolio of larger funds (either $150M+ or $200M+) by over 60%.

Similarly, the median return for a portfolio of funds sized $5-50M should outperform the median return for a portfolio of larger funds (either $150M+ or $200M+) by ~44%.

Interestingly, we believe this outputs debunks a myth about small funds being “riskier” investments than larger funds. It appears that one can get signficant upside skew in returns through a portfolio of small funds without there being any apparent impact on returns on the downside.

To be clear, we certainly find this analysis to be encouraging. But it is not an output. It does not factor skill into the analysis (for better or for worse) and it certainly underestimates some of the challenges involved in ensuring that one is able to source, underwrite and access the top-performing funds in any particular part of the market.

Conclusion

We are extremely excited about the growing awareness of the value that small funds have the potential to provide to their investors as well as to the venture ecosystem more broadly.

We hope that these frameworks and insights have been helpful.

We certainly encourage any thoughts and feedback and look forward to continuing to share more insights going forward.

Thanks for the article and the data.

Just simple question - when you write "our data" is this some kind of "generalistic LP database" or performance of funds you supported?

Nice work, Kyle. Having worked with emerging managers in an outsourced CFO capacity (and now being part of a $5-50m fund), I whole heartedly agree. Incentives between founders and investors is also more aligned -- managers only win if their companies win!